PPP Loan Warrant List: A Guide To Compliance & Success!

Is your business navigating the complexities of financial assistance programs? Understanding the warrant list for PPP loans is not just advantageous; it's a critical necessity for securing your company's financial future.

The Paycheck Protection Program (PPP), orchestrated by the U.S. government and administered through the Small Business Administration (SBA), emerged as a lifeline for countless small businesses during periods of intense economic turmoil. These loans were designed to provide essential financial relief, enabling businesses to meet crucial obligations such as payroll, rent, and operational expenditures. Central to this program's operation is the warrant list, a document that serves as the backbone of the agreement between lenders and borrowers. It dictates the terms, conditions, and guidelines that both parties must adhere to in order to participate in the PPP.

This comprehensive guide provides an in-depth analysis of the warrant list for PPP loans, examining its components, implications, and the strategies businesses can employ to ensure full compliance. Whether you're a seasoned business owner or a financial professional, this exploration will equip you with the necessary knowledge to effectively navigate the intricacies of PPP loans. The objective is to illuminate the crucial role the warrant list plays in maintaining the integrity of the program, detailing the obligations of lenders and borrowers, and underscoring the importance of using funds in accordance with stated guidelines. The insights provided will help businesses understand how to best benefit from the available financial support.

- Easy Stylish Hairstyles For Girls Quick Guide Tips

- Find Your Ideal Playa Cerca De Mi Beach Guide Tips

The PPP loan, initiated to aid small businesses during periods of economic instability, is a cornerstone of government relief efforts. Administered by the Small Business Administration (SBA), it offers loans to qualified businesses to cover vital expenses like payroll, rent, and utilities. The distinguishing characteristic of PPP loans lies in their potential for forgiveness, offering a pathway for businesses to have their loans forgiven if they utilize the funds for specific, approved purposes. This element underscores the significance of thoroughly understanding the warrant list for PPP loans, ensuring businesses align their usage of funds with program requirements to maximize their benefits.

To better understand the program, let's dive deeper into the key features:

- Forgivable loans when used for eligible expenses

- Flexible repayment terms to accommodate businesses' financial needs

- Tailored support for businesses with fewer than 500 employees

The following table summarizes the essential information regarding the Paycheck Protection Program:

| Feature | Description | Benefit |

|---|---|---|

| Loan Forgiveness | Loans are eligible for forgiveness if used for qualified expenses like payroll, rent, and utilities. | Reduced financial burden and potential for debt relief. |

| Flexible Repayment Terms | Repayment terms designed to accommodate the financial needs of businesses. | Provides businesses with manageable repayment schedules. |

| Targeted Support | Primarily aimed at supporting businesses with fewer than 500 employees. | Focuses resources on small businesses most affected by economic downturns. |

The warrant list for PPP loans is a foundational element of the program, serving as a legal agreement between lenders and borrowers. It is designed to establish a transparent framework, detailing the terms and conditions that both parties must adhere to, ensuring accountability throughout the loan process.

Within this agreement, several key components are defined, outlining the parameters of the loan:

- Loan amount and repayment terms

- Eligibility criteria for borrowers

- Compliance requirements to maintain eligibility

Businesses are strongly advised to thoroughly review the warrant list to ensure they meet all the stipulated requirements and fully understand their responsibilities. This is an indispensable step in maintaining compliance and avoiding any potential legal complications down the line.

To qualify for a PPP loan, businesses must meet specific eligibility criteria established by the SBA. These criteria are put in place to ensure that financial assistance is directed toward businesses that genuinely require support.

Here are the key eligibility requirements:

- Businesses with fewer than 500 employees

- Proof of financial need due to economic disruptions

- Compliance with SBA regulations and guidelines

Eligible businesses must also provide evidence of how they have been impacted by economic challenges, such as the effects of pandemics or natural disasters. Understanding these criteria is essential for successfully applying for and receiving a PPP loan.

The application process for a PPP loan involves a series of steps, each of which must be completed meticulously to ensure a successful outcome. Businesses are required to provide detailed information about their operations and financial status.

Here is a breakdown of the application process:

- Compile necessary documentation, including payroll records, financial statements, and business tax forms

- Complete the PPP loan application form, ensuring all information is accurate and up-to-date

- Submit the application to an approved lender, along with all required supporting documents

It's important that businesses thoroughly review the warrant list for PPP loans to make sure they fully comprehend the terms and conditions. This step is crucial for meeting all compliance requirements and avoiding potential issues during the loan process.

Compliance with the warrant list is critical for businesses seeking financial assistance through the PPP. This entails adhering to the specified terms and conditions, ensuring that funds are utilized appropriately, and that all obligations are met.

To ensure compliance, here are some best practices:

- Regularly review the warrant list to stay informed of any updates or changes

- Thoroughly document all expenses related to the PPP loan, maintaining detailed records

- Consult with financial advisors or legal experts to ensure full compliance

By diligently following these best practices, businesses can ensure they are compliant with the warrant list for PPP loans, mitigating the risk of legal and financial complications.

PPP loans offer numerous advantages to small businesses, making them a valuable resource for financial assistance. These benefits include loan forgiveness, flexible repayment terms, and support for essential expenses.

The key benefits of PPP loans include:

- Loan forgiveness for eligible expenses, such as payroll, rent, and utilities

- Flexible repayment options to accommodate businesses' financial situations

- Support for maintaining payroll and covering operational costs during challenging times

Businesses that successfully navigate the PPP loan process can leverage these benefits to maintain financial stability and resilience during uncertain economic periods. By securing a PPP loan, companies can bolster their ability to withstand economic hardships and maintain essential operations.

While PPP loans offer significant advantages, they also present challenges and risks that businesses must address. These include compliance issues, potential legal complications, and the risk of loan forgiveness denial.

To address these challenges, businesses should:

- Stay informed about updates to the warrant list for PPP loans

- Engage legal and financial experts to provide guidance and support

- Maintain meticulous records of all expenses related to the PPP loan

Proactive measures enable businesses to reduce risk and increase the likelihood of a positive PPP loan experience. By taking the steps needed to anticipate and manage these challenges, businesses can better position themselves for success.

Here are some frequently asked questions and their answers:

What is the warrant list for PPP loans?

The warrant list for PPP loans is a legal document that outlines the terms and conditions of the loan, ensuring compliance and accountability between lenders and borrowers.

Who is eligible for a PPP loan?

Businesses with fewer than 500 employees that demonstrate financial need and comply with SBA regulations are eligible for PPP loans. Additional criteria may apply depending on the specific circumstances of the business.

How can businesses ensure compliance with the warrant list?

Businesses can ensure compliance by regularly reviewing the warrant list, maintaining detailed records of all expenses, and seeking guidance from financial advisors or legal experts.

What types of expenses are eligible for loan forgiveness?

Eligible expenses typically include payroll costs, rent, mortgage interest, and utilities. There may be other eligible expenses, depending on SBA guidelines.

What happens if a business doesn't meet the requirements for loan forgiveness?

If a business does not meet the forgiveness requirements, the loan becomes subject to repayment with interest, as outlined in the loan terms.

How do I apply for loan forgiveness?

The SBA provides a loan forgiveness application, which requires detailed documentation. Your lender can guide you through the process.

What if I need additional funds after my initial PPP loan?

In certain cases, businesses may be eligible for a second-draw PPP loan, depending on eligibility criteria and the SBA's guidelines.

Where can I find the most current information on PPP loans?

The Small Business Administration (SBA) and the U.S. Department of the Treasury websites provide the most current and accurate information. See sources below.

The warrant list for PPP loans is a central aspect of the Paycheck Protection Program, promoting transparency and accountability in the loan process. By understanding the warrant list and adhering to its terms, businesses can successfully navigate the PPP loan process and benefit from the financial assistance it provides.

The PPP, with its warrant list at its core, has been a vital tool for supporting small businesses through challenging economic climates. Careful attention to the warrant list will undoubtedly help businesses benefit most from the program. As the economy evolves, programs like the PPP can provide the necessary assistance for maintaining financial stability and ensuring long-term sustainability.

Disclaimer: This article is intended for informational purposes only and does not constitute legal or financial advice. Always consult with a qualified professional for guidance tailored to your specific situation.

Sources:

- Small Business Administration - PPP Loan

- U.S. Department of the Treasury - PPP

- Carnival Dress Guide How To Shine Celebrate In Style

- Thumbs Up Guy A Deep Dive Into The Viral Icons Story

Warrant List PDF

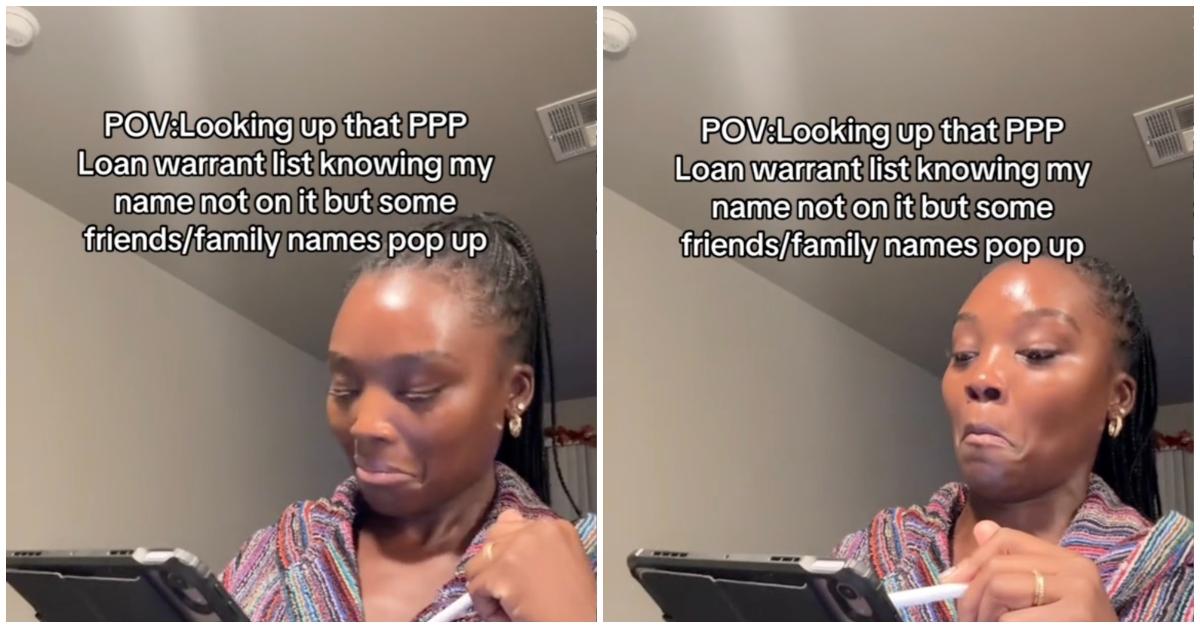

There's a PPP Loan Arrest List Going Around — or Is There?

Active Warrant Search